Kodak was once the dominant player in the photography industry, selling disposable cameras, film cartridges, and developing photos. However, they failed to invest in digital cameras, which they had invented. They were making so much money on film that they didn’t want to speed up the process of making the old technology obsolete. This approach made sense to Kodak, but customers increasingly preferred instant digital photos. Now, most Gen-Zs have probably never heard of Kodak.

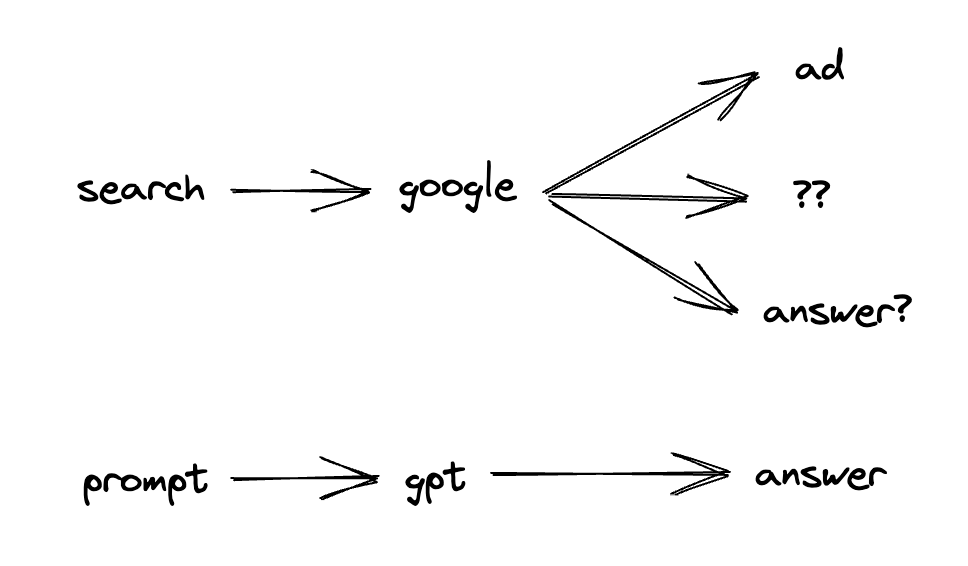

Google is currently the dominant player in the search industry, with almost 94% market share worldwide. Its lucrative business is being the gatekeeper between you and information. To users, its services are free, as the company earns revenue through targeted advertising slots displayed at the top of search results. Google’s advanced AI helps users find information, but its primary goal is to encourage ad clicks.

Enter ChatGPT. Rather than searching on Google and browsing multiple sites, ChatGPT engages users in conversation, providing precise information without ads. But it has its flaws. Critics dubbed it a bullshitter and a stochastic parrot, hallucinating so much it must have macrodosed. However, the release of GPT-4 significantly enhanced ChatGPT, causing some critics to shift from skepticism to apprehension.

Suddenly, it doesn’t seem inevitable that Google will rule the universe with the most advanced AI and the most data. Ironically, Google invented the transformer, the “T” in “GPT,” but failed to invest sufficiently in its commercialization. This hesitance partially stems from the “innovator’s dilemma,” as described by Clayton Christensen. Established industry giants try to milk their aging but highly profitable technology until disruptive newcomers eat their lunch with incrementally improved innovations.

Even when aware of the innovator’s dilemma, companies can still be disrupted by new technologies they fail to invest in. Andy Grove invited Clayton Christensen to discuss the innovator’s dilemma at Intel, yet Intel still succumbed to it. Intel clung to its outdated but lucrative x86 architecture and missed out on ARM, effectively losing the mobile market to Apple. Presently, Intel lags at least two chip generations behind TSMC.

Google is making a killing on selling search ads. Replacing their search with LLM-based search would result in fewer searches, since users would find information faster without clicking on ads. While Google’s cost per search query is 1.06 cents, ChatGPT’s estimated cost per query is 36 cents. At Google’s scale, this translates to a $36B reduction in operating income. Google faces an innovator’s dilemma: whether to invest in a superior technology that could potentially cannibalize its profits.

Unlike newcomers such as OpenAI and you.com , Google is a public company with shareholders to consider and a massive workforce of 190,000 employees. Even if CEO Sundar Pichai advocates for a full commitment to LLMs, he may struggle to gain shareholder support. Co-founders Larry Page and Sergey Brin would need to exercise their super-voting shares to redirect the company.

To be fair, Google is not completely sitting on its hands. It launched Bard, a ChatGPT competitor, which initially used the smaller LaMDA model but now employs PaLM , outperforming GPT-3 in some tests. Google also owns DeepMind and Anthropic, two of the most advanced AI teams in the field, and possesses one of the world’s largest data sets, crucial for training language models. However, Google had similar advantages before, such as in cloud computing, only to be outmaneuvered by more agile competitors like Amazon. The crucial question remains: Can Google invest sufficiently in this emerging technology to fend off disruption to their core business?